DealBook: Texas Car Lender Is Accused of Distortion in Subprime Inquiry

Photo

Richard Cordray, director of the Consumer Financial Protection Bureau, at a House panel last month.Credit Yuri Gripas/Reuters

Related Links

The cycle is a familiar one on Wall Street. First comes a lending boom. And then, after the abuses and excesses of a bubble, there is the government crackdown.

Now, as federal prosecutors and regulators wrap up many of their largest mortgage investigations, they are shifting their focus to another lending boom underway: the market for auto loans to people with shoddy credit.

On Wednesday, the investigations — several are already in the works, people with knowledge of the matter say — fixed on an auto lender in Texas, which the Consumer Financial Protection Bureau accused of tarnishing borrowers’ credit reports.

The lender, First Investors Financial Services Group, agreed to pay a $ 2.75 million penalty over accusations that it consistently gave giant credit reporting agencies like Experian and Equifax flawed reports about thousands of car buyers. The reports, the agency said, exaggerated the number of times that borrowers fell behind on their bills, a mistake that could jeopardize their ability to find housing or even get jobs.

First Investors, which is owned by a prominent New York private equity firm, did not acknowledge any wrongdoing.

“First Investors showed careless disregard for its customers’ financial lives by knowingly distorting their credit profiles for years,” Richard Cordray, the director of the consumer protection bureau, said on Wednesday.

The action comes as regulators and prosecutors worry that some of the same lending abuses that plagued the mortgage market in the run-up to the financial crisis — and signs that some borrowers’ loan applications included false information about income and employment — are showing up in the subprime auto market, the people familiar with the matter said.

Preet Bharara, the United States attorney in Manhattan, has begun a separate investigation into whether lenders have sold questionable auto-loan investments to investors. The investigation, which has sent subpoenas to General Motors Financial and Santander Consumer USA, two giant auto lenders, is focused on whether the lenders fully disclosed to investors the creditworthiness of borrowers whose loans made up the complicated securities.

Adding to the scrutiny, the Manhattan district attorney’s office is examining a number of potential abuses in the subprime auto loan market, according to two people with knowledge of the investigation.

The surge in auto lending, the people said, has many of the markings of the frenzied subprime mortgage market before its cratering helped precipitate the 2008 financial crisis.

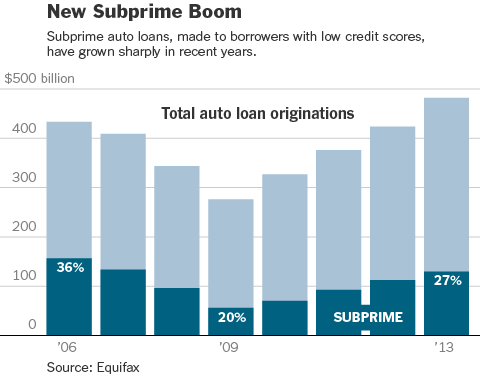

Loans to borrowers with dented credit has grown 130 percent in the five years since the immediate aftermath of the financial crisis. And one in four new auto loans last year went to buyers with credit scores at or below 640, according to Experian.

Photo

Credit

And just as was the case in the mortgage boom, Wall Street is helping stoke the growth in auto loans. First Investors, the lender at the center of the C.F.P.B. action, is owned by Aquiline Capital Partners. The private equity firm was founded by Jeffrey Greenberg, a former chief executive of Marsh & McLennan Companies and a son of American International Group’s former chief executive, Maurice R. Greenberg.

The explosive growth, though, includes loans that have false information about borrowers’ income and employment, according to a review by The New York Times of hundreds of bankruptcy court cases, civil lawsuits against lenders and loan documents. Federal prosecutors, the people briefed on the investigations said, are now examining just how many of those flawed loans wound up in complex bonds that are sold as securities to insurance companies, mutual funds and public pension funds.

Investors are not the only ones venturing into risky territory, regulators say. The Office of the Comptroller of the Currency, for example, has sounded alarms about the fallout for some of the nation’s largest banks if they continue to amass the subprime auto loans. Pointing to loosening credit terms, the agency said in a June report that signs of “increasing risk are noteworthy.”

Those signs are proliferating. On Wednesday, Experian reported a “significant increase” in the number of cars being repossessed in the second quarter. The overall automotive repossession rate jumped over 70 percent from the same period a year earlier. Delinquencies also inched up, Experian said.

“The rosy glow of perfect payment performance in the automotive space is beginning to tarnish,” said Melinda Zabritski, senior director of automotive finance at Experian Automotive.

The rising delinquencies are climbing even as the economy continues to improve. These early signs of tumult, some analysts say, suggest that loans ended up going to borrowers, including some relying entirely on social security, who could never afford to repay them in the first place.

For troubled borrowers, including millions of Americans already living on the financial margins, the costly car loans can push them further into debt, and thrust some into bankruptcy.

First Investors, the auto lender in Houston, exacerbated the pain for tens of thousands of borrowers, including some who successfully scrounged together their loan payments each month, the consumer protection bureau said. Executives at the company knew since 2011 that a flawed computer system was dispatching incorrect information about borrowers to credit bureaus, but did not fix the problem, the agency said. As a result, the company inflated the number of late payments for some borrowers and sent inaccurate information about when others stopped paying their loans.

Such inaccuracies can haunt borrowers for years. The credit score, a metric derived from a formula that includes outstanding debt and payment histories, has become an increasingly important number used to determine credit, housing decisions and sometimes job candidates.

Mr. Cordray of the C.F.P.B. said that First Investors “put consumers with credit profiles that were already impaired into an even more perilous position.” In a statement, First Investors said it had worked to correct the inaccuracies, adding that it chose to settle the matter with the consumer protection agency rather than bear the expense of a court battle.

The regulator is also broadly examining whether lenders saddle minority borrowers with more expensive loans. But the agency does not oversee the players that make up a big piece of the subprime market: car dealers. The dealers are the middlemen, who accept the loan applications and outline the terms and rates of the loans.

Because of an exemption in the Dodd-Frank financial overhaul, the 2010 law passed after the financial crisis, auto dealers remain regulated by the Federal Trade Commission. Lawmakers, consumer advocates and even President Obama criticized the exemption, sponsored by former Senator Sam Brownback, Republican of Kansas, and supported vigorously by the powerful National Automobile Dealers Association, for allowing dealers to escape the toughest scrutiny.

At the time the Senate debated the exemption, Mr. Obama criticized what he deemed a “lobbyist-inspired” carve-out, saying that “it would allow them to inflate rates, insert hidden fees into the fine print of paperwork and include expensive add-ons that catch purchasers by surprise.”

The auto dealers trade group argued that their members were not responsible for the 2008 financial crisis.

“Unlike mortgages, auto finance did not experience a subprime lending crisis and does not pose a systemic risk,” the group said at the time.

A version of this article appears in print on 08/21/2014, on page B1 of the NewYork edition with the headline: A Car Lender Is Accused of Distortion.

NYT > Automobiles

Bài Liên Quan:

Không có bài liên quan.